Micromine invited me to their office and gave me a preview of

their implicit modelling product

before its release. What I saw was quite impressive, so I asked myself: Will Micromine’s implicit modeller be a market winner? From what I saw, I expect it will be popular, but only time will tell. For the consumer (especially the Micromine user who is also a current Leapfrog user), these are exciting times. Those who are only occasional users of Leapfrog will finally have a choice other than ARANZ Geo products and I predict that many will choose Micromine’s product over Leapfrog software.

There are six compelling reasons why Micromine’s implicit modelling software should be successful.

All these reasons are equally important, but before I get to them, I’ll briefly comment on ‘Dynamic Shells’ from Gemcom (now Geovia), following up on an

earlier post about that software. Some of my contacts who use Geovia products (Gems and Surpac) have confirmed that, despite Geovia’s marketing language and spin, Dynamic Shells is NOT based on the implicit method of modelling—as I had suspected. Consumers would be well-advised to look into Geovia’s claims before they open their wallets. What Geovia has been able to do is compress conventional block models into very small objects that take up little space. This is an impressive feat and those who use Dynamic Shells say this is the best thing about the recent versions of Gems. But this doesn’t make Dynamic Shells an implicit modeller, which has infinite resolution. Nevertheless, Geovia seems to believe that Dynamic Shells can compete as an alternative to Leapfrog. As I said previously, Geovia may be able to pull this off with their mighty marketing budget.

So, what about Micromine’s implicit modeller? Do they have the real thing, or are they pretending, like Geovia?

Advantage 1: Micromine’s implicit modeller is the real deal, not marketing hype.

Micromine is the second generalised mining product (GMP) company to release a compelling implicit modelling competitor to Leapfrog (Micromine was beaten by Mintec Inc’s MineSight by a few months; I’ll discuss MineSight’s product in another ‘first looks’ post like this one).

How do I know that Micromine’s implicit modeller is a true competitor to Leapfrog software? Because I came up with the Leapfrog implicit modelling concept in 2001. The Leapfrog Mining product was designed based on my vision; it was released as commercial software in December 2003. Geomodeller, or ‘3DWEG’ as it was known then, was the only other implicit modeller on the market; it was also released about the same time as Leapfrog. Until late 2012, there were no competitors to these unique products that used mathematical functions to model geological data.

The main difference between version 1 of Leapfrog which came out in 2003 and Micromine’s new implicit modeller is that Micromine’s implicit modeller uses a local—not global—interpolator.

FastRBF, which is the original interpolation engine of Leapfrog (v.1), was developed by ARANZ Ltd and is still available from Farfield Technology. (Note: Farfield Technology Ltd and ARANZ Geo Ltd are subsidiaries of ARANZ Ltd, which owns the intellectual property for FastRBF.) This website of Farfield Technology, is pretty much unchanged since I discovered the existence of FastRBF back in 2001 when I searched the internet for ‘RBF Interpolation’. FastRBF is the clever 3D interpolator within Leapfrog that no other company has been able to replicate. It takes an entire point dataset and comes up with an interpolation result that resembles a local interpolation. It is highly efficient, and, as far as I am aware, still does not have a direct competitor in the market. However, it’s now 2013 and local interpolators are beginning to catch up to FastRBF’s performance.

But using a local interpolator is slower than using Leapfrog. A local interpolator also can’t handle hundreds of thousands of points easily. Local interpolation methods are computer intensive, they require local searches of data points (not needed in global interpolation), and the patchwork of results have to be stitched and blended together. All this results in extra processing, requires time, and is particularly challenging with larger datasets.

However, I’ve been teaching geologists how to avoid processing large datasets in Leapfrog Mining and how to use techniques that circumvent this requirement. Processing large amounts of data can be avoided and is completely unnecessary if you model intelligently by incorporating geological and structural geological knowledge in the modelling process. Using these methods, I have rarely processed anything in Leapfrog that’s more than 100,000 points (other than

LIDAR topography) and I can model drillhole datasets perfectly. For dense LIDAR data, Micromine has a clever point-thinning function that works very well without significantly affecting the outcome of the modelling—Micromine can process a dataset that has many hundreds of thousands of points and bring it to a number that can be easily modelled with their implicit modeller.

What’s so surprising (at least to me) is that Micromine’s new implicit modelling software is extremely mature and is well ahead of version 1 of Leapfrog (released in 2003); Micromine’s software looks more like version 1.4 of Leapfrog (released in January 2005).

Effectively, Micromine has stuffed four years of early Leapfrog development into their first release. This is impressive to say the least.

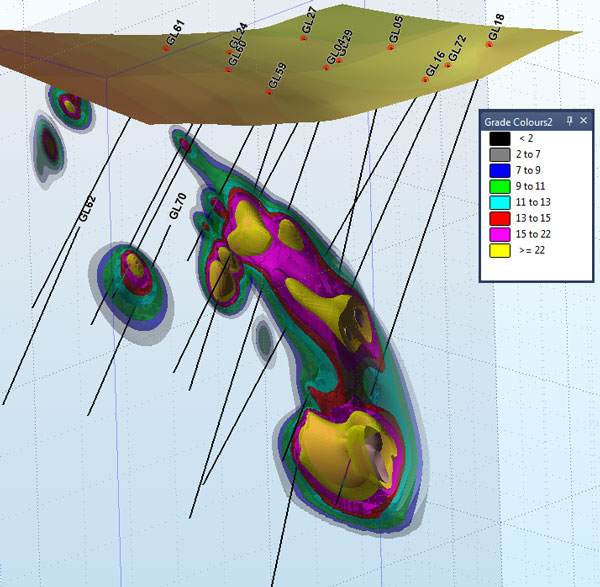

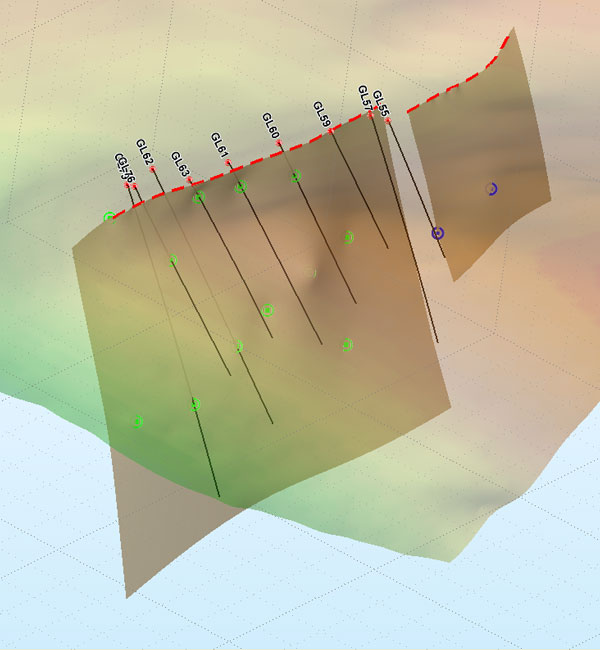

Micromine’s product can interpolate isotropic and anisotropic grade and lithology data (Figure 1). It can also incorporate points and polylines into the lithological modelling process (Figure 2). This second feature, which is essential for refining the model, was not available in Leapfrog for some time after its initial release.

Figure 1. Anisotropic grade interpolation result from Micromine’s implicit modeller.

Figure 1. Anisotropic grade interpolation result from Micromine’s implicit modeller.

Figure 2. Drillhole intercepts points (green circles) are interpolated and incorporated with a drawn polyline on the topography surface (red dash).

Micromine’s local implicit interpolator may not yet beat FastRBF, which is very fast and can accept large sets of data, but good results require clever geological thinking, not just fast processing of large datasets. With the incorporation of geologically clever methods and their new implicit modeller, Micomine should easily accomplish what Leapfrog has achieved over the last ten years—but in a fraction of the time.

Advantage 2: The marketing started for Micromine’s product ten years ago.

Micromine’s implicit modelling software comes ten years after Leapfrog was first released (December 2003). When I sold the first copies of Leapfrog to AngloGold Ashanti and Harmony Gold in Perth, very few geologists and companies knew about Leapfrog and what it was all about. The situation today is completely different. Most companies either have a copy of Leapfrog, or they have at least heard about it or seen its outputs.

It’s a great advantage for Micromine to have another company do all the pioneering legwork because it cuts down the work, the talk, and most importantly, costs. This wasn’t the case when I went out marketing Leapfrog alone in 2003. No one had heard about Leapfrog because I was the only person talking about it, and it took a lot of effort to sell Leapfrog with zero licences in the market. It was even difficult to convert people within SRK Consulting, the company that I worked for, let alone companies outside SRK.

I remember travelling to a mine out from Kalgoorlie twice, with an invitation to present to the geologists, and both times the geology manager had to attend more important meetings. That mine took another three years to buy, so the lead times to actual sales were extremely long. Ten years on, that particular mining company is now one of the strongest proponents of Leapfrog, but I know from personal experience that it takes a lot of effort to sell a product that is based on a completely new methodology. What took maybe five years to accomplish in the early days of Leapfrog sales can probably be achieved in one year by Micromine. This selling will be done by using Micromine’s network of offices and will be assisted by the fact that everyone has already heard of Leapfrog and implicit modelling, thanks to the Leapfrog’s marketing of implicit modelling.

Advantage 3: Marketing into regions where Leapfrog is absent.

Micromine has really expanded since 2001 when I visited their office to see if they would write the graphical user interface (GUI) for FastRBF. Micromine declined the opportunity at the time, but they were a small Australian-focused company back then (to be fair, we asked all the major GMPs with offices in Perth and they all declined). Now, Micromine’s presence is big overseas, particularly in the growing markets of Russia and China, where Leapfrog doesn’t have any market presence.

Exploration in former Soviet Union countries, such as Kazakhstan, is just beginning to open up and more countries in this region will no doubt follow. Micromine has an office in the former Soviet Union and has many users in the region, and thus is poised to take advantage of this business opportunity. Micromine clearly feels that this is an important strategy, as their Product and Operations Manager in Perth is a native Russian mining engineer.

By contrast, where are Leapfrog’s offices located, and what mining professionals are leading their company and the development of Leapfrog? The main office of ARANZ Geo is in Christchurch, New Zealand, and apart from a small office in Perth, Western Australia, independent consultants represent them in other countries and continents. After SRK’s departure from ARANZ Geo, there is no-one at the executive level in ARANZ Geo with experience in the exploration or mining industry.

It’s probably already too late for ARANZ Geo to set up offices in Russia or China. Micromine and other GMPs have been in these regions for years now and loyal customers will have very little incentive to change to a third-party implicit modeller.

For them, the first implicit modeller they will see will be Micromine’s and not Leapfrog’s.

Figure 3. Lithological models produced with Micromine's implicit modeller.

Figure 3. Lithological models produced with Micromine's implicit modeller.

Advantage 4: Price.

During the last 12 years of the boom period, the price of Leapfrog was not an issue for most companies because it saved so much time that the cost of the software could be recovered the first time you used it.

That sentiment has now changed quite a bit, as a result of cost-cutting measures introduced by many companies over the past six months.

If loyal Micromine users were given a choice between using a third-party Leapfrog product that charges an annual fee of ~$12,000/year vs $7,000 outright purchase price for Micromine’s module (with discounts for existing Micromine licence holders), take one guess as to which product the geologists (and company accountants) will be signing up for?

Alternatively, if you compare Micromine’s purchase price of $7,000 to the nearly $30,000 for an outright purchase of Leapfrog, then you don’t need an accounting degree to work out how overpriced Leapfrog appears to be. Unless geologists can take full advantage of all the features in Leapfrog, and can effectively use the $30,000 worth of software, the purchase price of Leapfrog plus $5,000 a year maintenance is ridiculously steep compared to Micromine’s offer.

In addition to the steep base price, Leapfrog Geo is introducing ‘user-pays’ modules into their software (eg. plugin to

ioGAS), so you will incur extra costs if you require extra features.

This pricing model move by ARANZ will naturally drive people to look at what the competition is offering.

I predict that it won’t be long before Micromine announces ioGAS plugins for their own product.

Advantage 5: Market differentiation of Leapfrog from competitors is non-existent.

First movers always have an advantage.

Or do they? It all depends on whether the early industry leaders actually took advantage of their lead, or if they squandered the lead time that they had all to themselves.

The reason why Leapfrog has been so successful until now was because FastRBF is not easy to replicate. In April 2001, I was an employee of SRK Consulting Australasia and had found FastRBF using a Google search. I convinced my boss and MD of SRK Consulting Australasia that the use of this fast interpolation code in a new software product was the way of the future for geological modelling. More importantly, there was unlikely to be any competition for years because FastRBF was difficult to replicate.

ARANZ had no idea that FastRBF could be used in the mining industry until I told them how it could be applied. Unfortunately, they have not invented anything new during the last 12 years since they were told that FastRBF could be used for geological modelling. Their most recent 'innovation effort' has been focused on writing a new GUI to FastRBF

called Leapfrog Geo. Every other function in Leapfrog products, apart from FastRBF, can be easily replicated by an individual or software company.

FastRBF had no competition in 2001, but 12 years on, FastRBF faces serious competition.

What ARANZ should have done over the last decade or so was to differentiate themselves from any competing products even if they did not exist, in the expectation that they would arrive in the future. Back in 2006, I heard rumours about Maptek developing a product to compete with Leapfrog, so it was not a matter of IF but WHEN competition would arrive.

The probability of future competition was certain, but during this time ARANZ didn’t prepare themselves for it.

And, basically that sums up the problem with Leapfrog.

Over a decade of Leapfrog development, ARANZ Geo have effectively squandered what could have been an excellent opportunity to completely change the landscape of how geological modelling is done.

In their first ten years, ARANZ Geo attained a user base of between 600 and 1000 annual lease users of Leapfrog Mining; they are now trying to replace this success with a completely different workflow and as yet unproven product called Leapfrog Geo. Micromine executives are completely perplexed and no doubt delighted by this move by ARANZ. The last thing a software company should do is alienate their own customers by introducing a product that competes with your own successful flagship product that everyone is using and has been using for years. Only time will tell if this move to Leapfrog Geo will be fatal to ARANZ Geo’s business, but I expect that companies like Micromine won’t sit still and will take advantage of this confusion.

Advantage 6: Micromine is a GMP; Leapfrog isn’t.

My long-term vision for Leapfrog when I was involved in its development was that it would compete with GMPs in the future, and it would achieve this in a completely different way from how all GMPs currently compete with each other. That plan was never realised once ARANZ Geo decided that geological knowledge and intelligence wasn’t required to develop geological modelling software. Now, Leapfrog is competing directly with GMPs without tools or industry knowledge to assist them.

Thanks to the lack of differentiation, Leapfrog is now effectively competing head-to-head with GMPs, but Leapfrog is not a GMP and it is unlikely that it will ever be a GMP. This is Micromine’s main advantage over Leapfrog.

Micromine’s loyal users know how to use Micromine, and it will only require a little more training for those users to use the implicit modeller. They don’t have to learn totally different software. Even if Leapfrog Geo is easier to use, as ARANZ Geo would argue, Leapfrog still cannot provide the end-to-end solution that clients are seeking. Why should mining and exploration companies lease third-party software products like Leapfrog at an extra cost when they can do almost the same thing within the Micromine software that they already have?

We will bring you a detailed review of Micromine’s implicit modeller in a future blog post. If you think of other advantages Micromine offers over Leapfrog (or vice versa), why not register with us and leave a comment? We would like also to hear from users of Micromine’s implicit modeller.

-